Why Strategic Debt Payoff Matters

The average American household carries over $6,000 in credit card debt, paying hundreds of dollars in interest each year. Without a strategic plan, minimum payments can keep you trapped in debt for decades. The difference between random payments and a strategic approach can save you years of payments and thousands of dollars.

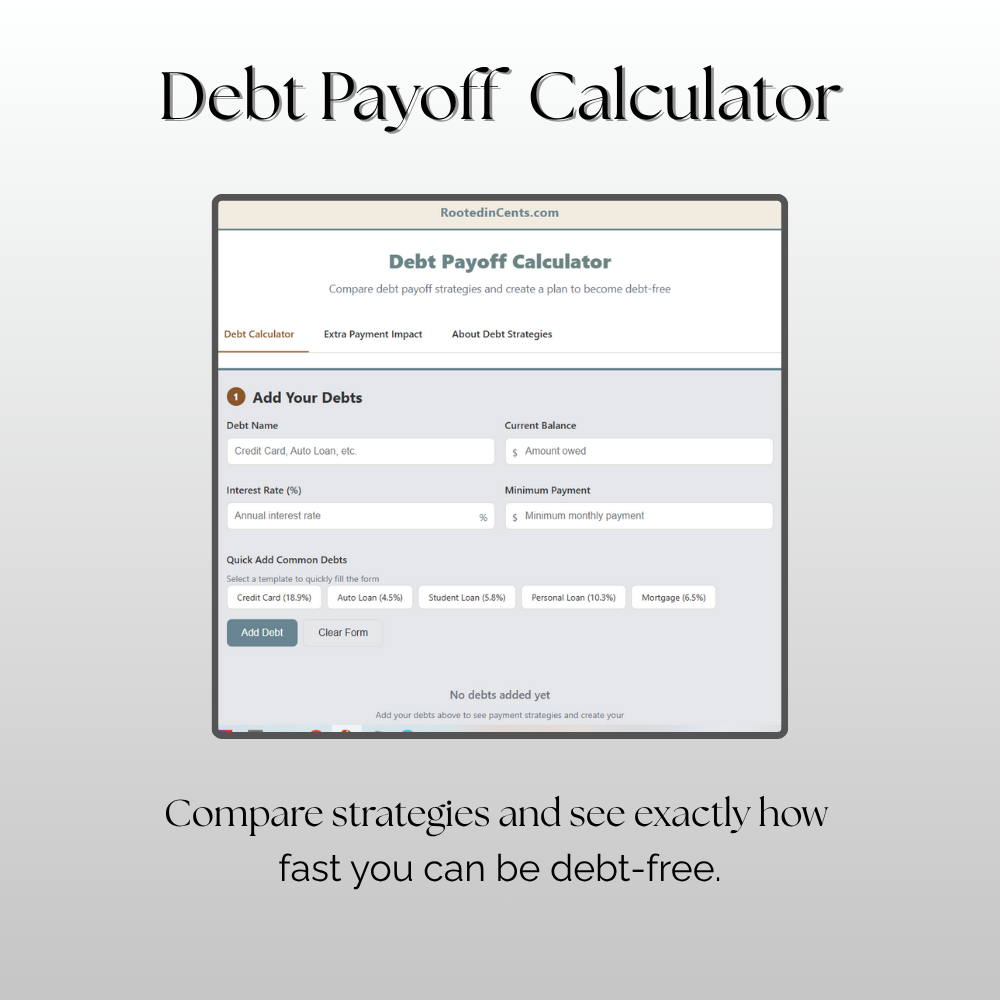

Our Debt Payoff Calculator helps you create a personalized strategy that works with your budget and accelerates your path to financial freedom.

Powerful Features of the Debt Payoff Calculator

Multiple Payoff Strategies

- Debt Avalanche Method: Pay minimums on all debts, then attack highest interest rate first (saves the most money)

- Debt Snowball Method: Pay minimums on all debts, then attack smallest balance first (provides psychological wins)

- Custom Strategy: Create your own payoff order based on your priorities

- Hybrid Approach: Combines both methods for optimal results

Comprehensive Debt Analysis

- Total Interest Calculations: See exactly how much interest you’ll pay with each strategy

- Payoff Timeline: Know exactly when each debt will be eliminated

- Monthly Payment Planning: Optimize your payment amounts for faster payoff

- Extra Payment Impact: See how additional payments accelerate your timeline

Visual Progress Tracking

- Payoff Schedule: Month-by-month breakdown of payments and remaining balances

- Interest Savings: Compare strategies to see potential savings

- Milestone Tracking: Celebrate wins as you eliminate each debt

How to Use the Debt Payoff Calculator

Step 1: List All Your Debts

Enter each debt with its current balance, minimum monthly payment, and interest rate. Include credit cards, personal loans, student loans, and any other consumer debt (excluding your mortgage).

Step 2: Choose Your Strategy

Select between the debt avalanche (mathematically optimal) or debt snowball (psychologically motivating) method. The calculator shows results for both so you can compare.

Step 3: Set Your Total Monthly Payment

Determine how much you can dedicate to debt payments each month. Even an extra $50-100 can dramatically reduce your payoff timeline.

Step 4: Review Your Payoff Plan

See your complete debt elimination timeline, total interest saved, and month-by-month payment schedule. Use this as your roadmap to financial freedom.

Life-Changing Benefits of Strategic Debt Payoff

Massive Interest Savings

Strategic debt payoff can save you thousands of dollars in interest charges. The calculator shows exactly how much you’ll save with each approach.

Accelerated Financial Freedom

What might take 20+ years with minimum payments could be accomplished in 2-5 years with a strategic approach and modest extra payments.

Improved Credit Score

As you pay down balances, your credit utilization ratio improves, potentially boosting your credit score and qualifying you for better interest rates.

Reduced Financial Stress

Having a clear plan and seeing progress reduces anxiety about money and gives you hope for a debt-free future.

Increased Cash Flow

Once debts are eliminated, all that money becomes available for savings, investments, or improving your quality of life.

Debt Avalanche vs. Debt Snowball: Which is Right for You?

Choose Debt Avalanche If:

- You’re motivated by saving money and mathematical efficiency

- You have significant differences in interest rates between debts

- You can stay motivated without frequent “wins”

- Your highest interest debt isn’t overwhelmingly large

Choose Debt Snowball If:

- You need psychological motivation and frequent victories

- You’ve struggled to stick with debt payoff plans before

- Your interest rates are relatively similar across debts

- You have several small debts you can eliminate quickly

Strategies to Accelerate Your Debt Payoff

Find Extra Money for Debt Payments

- Use the envelope budgeting method to reduce spending

- Cancel subscriptions and memberships you don’t use

- Sell items you no longer need

- Take on a side hustle or freelance work

- Use tax refunds and bonuses for debt payments

Lower Your Interest Rates

- Call credit card companies to negotiate lower rates

- Consider a balance transfer to a lower-rate card

- Look into debt consolidation loans

- Explore credit union alternatives with better rates

Avoid Adding New Debt

- Create an emergency fund to avoid borrowing

- Use cash or debit cards instead of credit

- Plan major purchases and save for them in advance

- Address the root causes of overspending

Common Debt Payoff Mistakes to Avoid

Not Having a Written Plan

Without a clear strategy, it’s easy to get discouraged or make poor payment decisions. Our calculator gives you a concrete plan to follow.

Focusing Only on Minimum Payments

Minimum payments are designed to keep you in debt as long as possible. Even small extra payments can cut years off your timeline.

Closing Paid-Off Credit Cards

Keep old accounts open to maintain your credit history length and improve your credit utilization ratio.

Not Celebrating Milestones

Debt payoff is a marathon, not a sprint. Celebrate each paid-off debt to maintain motivation for the journey ahead.

Start Your Debt-Free Journey Today

Every day you wait to create a debt payoff strategy costs you money in interest charges. The sooner you start, the faster you’ll reach financial freedom and the more money you’ll save.

Don’t spend another month making random debt payments. Get a clear, strategic plan that shows you exactly how to eliminate your debt in the shortest time possible.

Ready to break free from debt? Use our Debt Payoff Calculator now and discover your personalized path to financial freedom.

Explore our complete collection of calculators and money-saving resources.