Why Optimizing Credit Card Rewards Matters

Leaving money on the table with your credit cards? Our Credit Card Rewards Optimizer helps you maximize cashback and points based on your actual spending patterns.

The average household earns less than $300 annually in credit card rewards, but strategic card users can earn $1,000-$2,000 or more from the same spending. The difference lies in understanding your spending patterns and choosing cards that maximize rewards for your specific lifestyle.

Our Credit Card Rewards Optimizer analyzes your spending habits and recommends the optimal card strategy to maximize your rewards without changing your spending behavior.

Advanced Features of the Rewards Optimizer

Spending Pattern Analysis

- Category Breakdown: Analyze spending across groceries, gas, dining, travel, and general purchases

- Seasonal Variations: Account for holiday spending and irregular expenses

- Monthly vs. Annual Patterns: Identify opportunities for rotating category cards

- Payment Behavior: Ensure reward strategies align with responsible credit use

Card Recommendation Engine

- Multi-Card Strategies: Optimize combinations of cards for maximum rewards

- Annual Fee Analysis: Calculate whether premium cards justify their costs

- Sign-Up Bonus Optimization: Factor in welcome bonuses and spending requirements

- Credit Score Considerations: Match recommendations to your credit profile

ROI Calculations

- Net Annual Value: Total rewards minus annual fees and costs

- Breakeven Analysis: Determine minimum spending to justify premium cards

- Opportunity Cost: Compare your current strategy to optimal alternatives

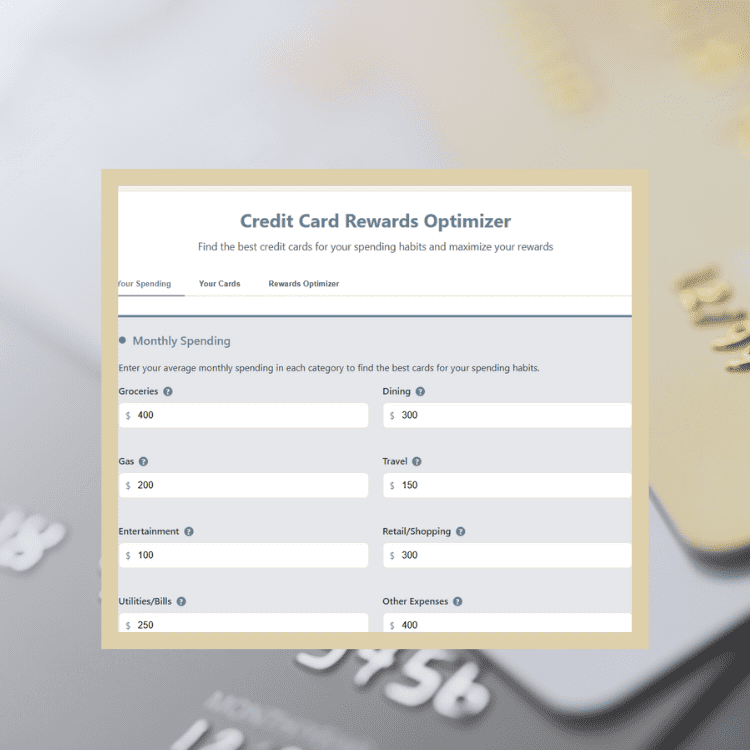

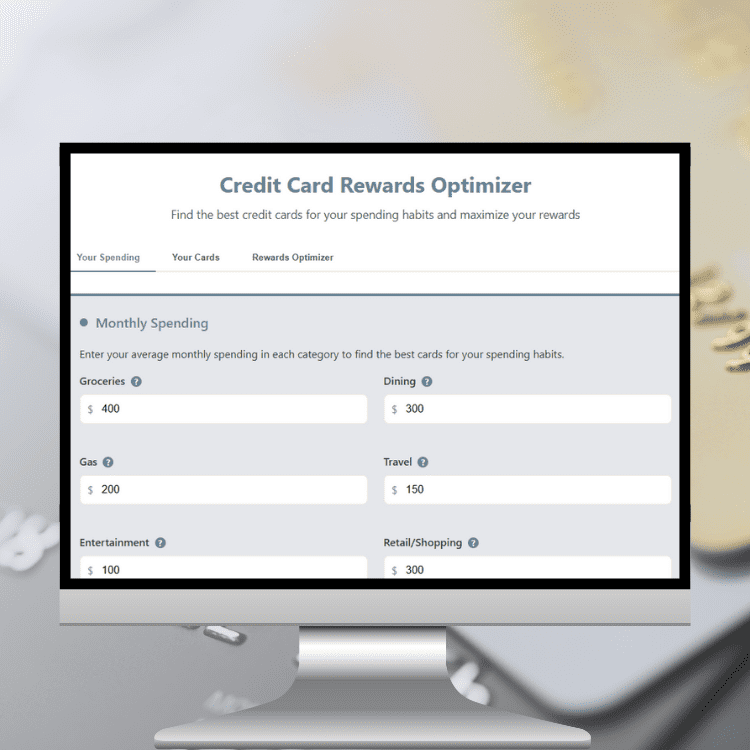

How to Use the Credit Card Rewards Optimizer

Step 1: Input Your Spending Data

Enter your monthly spending in different categories like groceries, gas, dining, travel, and general purchases. Use actual numbers from recent statements for accuracy.

Step 2: Specify Your Preferences

Indicate whether you prefer cashback, travel rewards, or flexibility. Also specify your credit score range and comfort level with annual fees.

Step 3: Review Current Card Performance

If you have existing cards, input their reward structures to see how well they match your spending patterns.

Step 4: Get Personalized Recommendations

Receive customized card recommendations with projected annual rewards, optimal usage strategies, and implementation timelines.

Benefits of Strategic Credit Card Optimization

Significant Reward Increases

Optimizing your card strategy can double or triple your annual rewards without changing spending habits. Many families can earn an extra $500-$1,500 annually through better card selection.

Travel and Experience Opportunities

Strategic use of travel rewards cards can fund family vacations, business travel, or unique experiences that would otherwise strain your budget.

Cash Flow Improvement

Cashback rewards provide direct budget relief, while sign-up bonuses can fund emergency expenses or accelerate savings goals.

Credit Score Benefits

Responsible use of multiple cards can improve your credit utilization ratio and payment history, boosting your credit score over time.

Common Credit Card Categories and Optimal Strategies

Grocery Spending Optimization

Cards offering 3-6% on groceries can provide substantial returns for families. Some cards have quarterly limits, while others offer unlimited rewards in this category.

Gas Station Rewards

With gas prices fluctuating, cards offering 3-5% at gas stations can provide meaningful savings for commuters and families with multiple vehicles.

Dining and Entertainment

Restaurant spending often earns 2-4% with many cards, making this category valuable for frequent diners or families who eat out regularly.

Travel Rewards Maximization

Travel cards can offer 2-5x points on travel purchases, plus valuable perks like free checked bags, airport lounge access, and travel insurance.

Advanced Reward Optimization Techniques

Rotating Category Mastery

Some cards offer 5% cashback on rotating categories that change quarterly. Maximizing these requires planning and sometimes purchasing gift cards during bonus periods.

Manufactured Spending Awareness

Understanding legitimate ways to increase spending in bonus categories can amplify rewards, but requires careful attention to card terms and conditions.

Sign-Up Bonus Timing

Strategic timing of new card applications around large purchases or planned expenses can help meet spending requirements for valuable welcome bonuses.

Redemption Optimization

Understanding the best redemption methods for different types of rewards ensures you get maximum value from accumulated points and miles.

Avoiding Common Credit Card Rewards Mistakes

Chasing Rewards While Carrying Debt

Interest charges negate reward value. Only optimize for rewards if you pay balances in full monthly and never carry debt to earn rewards.

Overspending for Rewards

Spending extra money to earn rewards defeats the purpose. Stick to your normal spending patterns and let rewards be a bonus, not a spending motivator.

Ignoring Annual Fees

Always calculate net value after annual fees. A card with great rewards but high fees might provide less value than a no-fee alternative.

Not Using Earned Rewards

Points and miles can lose value over time due to program changes. Redeem rewards regularly rather than hoarding them indefinitely.

Responsible Credit Card Rewards Strategy

Maintain Perfect Payment History

Late payments can trigger penalty APRs and fees that eliminate reward value. Set up automatic payments to ensure you never miss due dates.

Monitor Credit Utilization

Keep total credit utilization below 30% and individual card utilization even lower to maintain good credit scores while earning rewards.

Track Spending Categories

Use budgeting tools or apps to monitor spending and ensure you’re using the optimal card for each purchase category.

Review and Adjust Regularly

Your spending patterns and available cards change over time. Review your strategy annually to ensure continued optimization.

Maximize Your Credit Card Rewards Today

Credit card rewards represent free money for responsible users who pay balances in full monthly. With the right strategy, you can earn substantial cashback or valuable travel rewards from spending you’re already doing.

Stop leaving money on the table with suboptimal credit card choices. Get a personalized rewards strategy that maximizes your earning potential while maintaining responsible credit habits.

Ready to optimize your credit card rewards? Use our Credit Card Rewards Optimizer and discover how much more you could be earning from your everyday spending.

Explore more calculators and money-maximizing strategies in our resource library.