Why Your Monthly Budget Fails With Bi-Weekly Pay

The Silent Budget Killer

A perfect budget is in place. You track every expense. All the advice is followed. But somehow, you’re still broke before payday arrives. Sound familiar?

If you’re one of the 77 million Americans paid bi-weekly, your budget isn’t failing because you’re bad with money. It’s failing because you’re using the wrong system.

The Bi-Weekly Pay Problem Nobody Talks About

Traditional budgeting advice assumes everyone gets paid monthly. But if you’re paid every two weeks, you face unique challenges that monthly budgets completely ignore:

26 Paychecks per year. (not 24!)

10 Months with three paychecks over 5 years

2.17 Average paychecks per month

Why Monthly Budgets Don’t Work for Bi-Weekly Pay

Here’s what happens when you try to force bi-weekly income into a monthly budget:

Sarah’s Story: The Cash Flow Gap

Sarah earns $4,000 per month ($2,000 bi-weekly). She budgets $4,000 for monthly expenses, thinking she’s covered. But look what actually happens:

January: Gets paid Jan 6th and Jan 20th = $4,000 ✓

February: Gets paid Feb 3rd and Feb 17th = $4,000 ✓

March: Gets paid Mar 3rd, Mar 17th, and Mar 31st = $6,000

Most months, her expenses are due before her second paycheck arrives, creating unnecessary cash flow stress.

The Hidden Costs of Cash Flow Misalignment

When your income doesn’t align with your expenses, you pay hidden costs:

- Overdraft fees: Average $35 per incident when expenses hit before payday

- Credit card interest: Using cards to bridge gaps costs 18-29% annually

- Late payment fees: Missing due dates because of cash flow timing

- Stress and anxiety: Constantly worrying about making it to payday

- Missed opportunities: Can’t take advantage of deals due to timing

The Solution: Bi-Weekly Budget Alignment

Instead of forcing bi-weekly income into monthly buckets, align your budget with your actual pay schedule. This eliminates cash flow gaps and maximizes your money’s efficiency.

How to Master Bi-Weekly Budgeting

1. Map Your Paycheck Calendar

Then calculate exactly when you’ll receive all 26 paychecks this year. Identify which months have three paychecks.

2. Align Bills with Cash Flow

Schedule bill payments based on your paycheck timing, not calendar months. This prevents cash flow gaps.

3. Plan for 3-Paycheck Months

Use those two extra paychecks strategically for debt payoff, emergency fund, or irregular expenses.

4. Build a Mini Emergency Buffer

Keep 1-2 weeks of expenses in checking to smooth out any timing hiccups.

5. Automate Everything

Set up automatic transfers and bill pays aligned with your paycheck schedule.

Real Results from Bi-Weekly Budget Alignment

The Johnson Family Results

After switching to bi-weekly budgeting, the Johnson family:

- Eliminated $420 in annual overdraft fees

- Stopped using credit cards for cash flow gaps

- Saved an extra $4,000 annually from the two 3-paycheck months

- Reduced financial stress and improved sleep quality

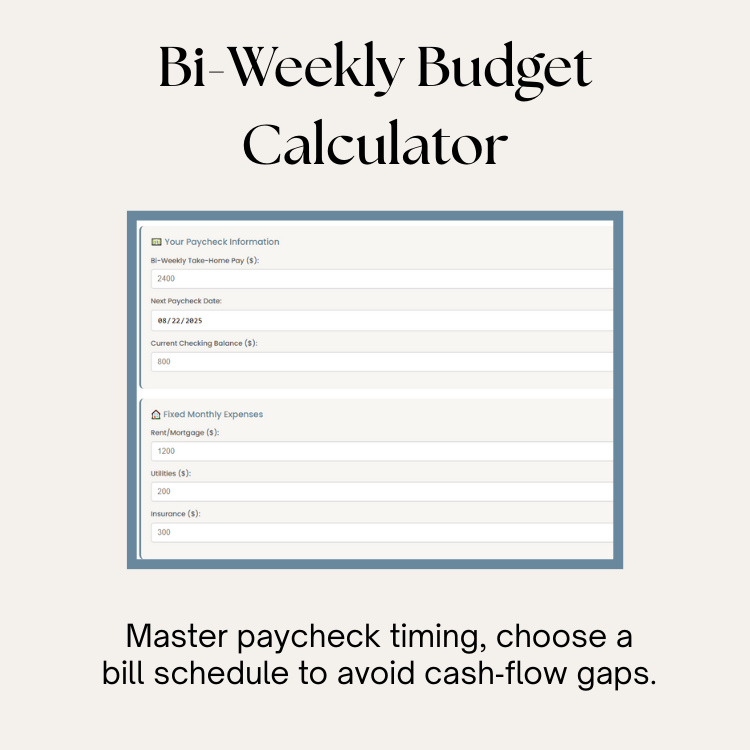

Master Your Bi-Weekly Budget in Minutes

Ready to stop struggling with cash flow gaps? Our Bi-Weekly Budget Calculator does the heavy lifting for you:

- Calculates your exact paycheck dates for the entire year

- Shows you which months have 3 paychecks

- Aligns your bills with your cash flow

- Provides strategies for 3-paycheck months

- Eliminates broke-before-payday cycles

- Works on any device, anywhere

Try Our Bi-Weekly Budget Calculator

Get your personalized results in under 5 minutes. Calculate My Bi-Weekly Budget

Don’t Let Your Pay Schedule Control Your Budget

You work hard for your money. Don’t let poor cash flow timing steal hundreds in fees and stress. With proper bi-weekly budget alignment, you can:

- Stop worrying about running out of money before payday.

- Maximize the value of your 3-paycheck months.

- Eliminate overdraft and late payment fees.

- Build wealth faster with better cash flow management.

- Sleep better knowing your money is working efficiently.

Ideally, the best time to fix your budget was when you started getting paid bi-weekly. The second-best time is right now.

Want a bi-weekly budget that actually works? Calculate My Bi‑Weekly Budget. Get personalized results in under 5 minutes.

Read here for more info and step-by-step tips.