Why Grocery Savings Matter More Than Ever

Food prices have increased significantly, with the average family spending over $7,700 annually on groceries. For many households, food represents the second-largest expense after housing. The good news? Unlike fixed expenses like rent or insurance, your grocery bill offers tremendous opportunities for savings without sacrificing nutrition or satisfaction.

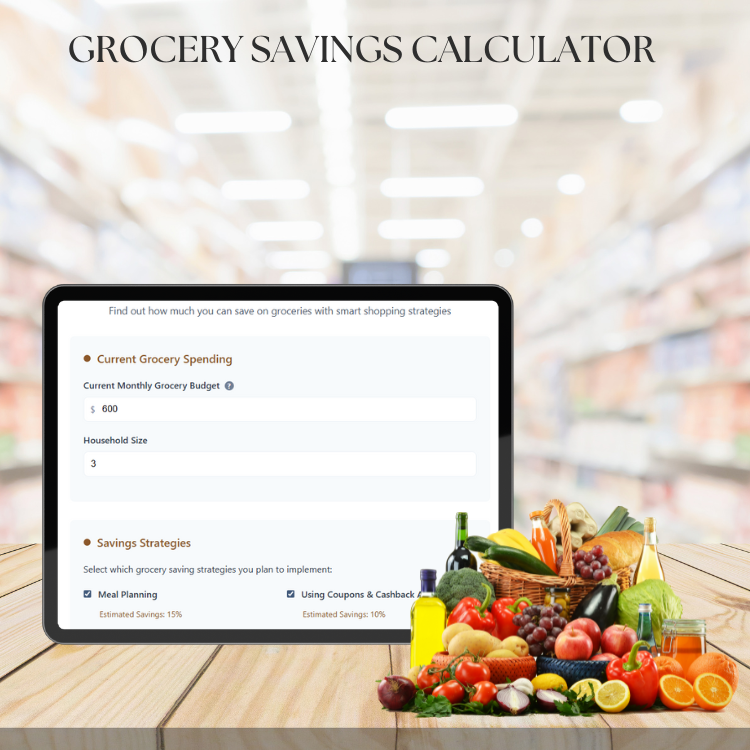

Our Grocery Savings Calculator analyzes your current spending patterns and shows you the real impact of various money-saving strategies, helping you reduce your food budget by 20-40% or more.

Comprehensive Features of the Grocery Savings Calculator

Shopping Strategy Analysis

- Coupon Impact: Calculate potential savings from manufacturer and store coupons

- Store Loyalty Programs: Track cashback and reward point benefits

- Sale Shopping: Measure savings from timing purchases with sales cycles

- Generic Brand Substitution: Compare name brand vs. store brand costs

- Bulk Buying Analysis: Determine when buying in bulk saves money

Meal Planning Integration

- Waste Reduction: Calculate savings from reducing food waste

- Seasonal Planning: Factor in seasonal price variations for produce

- Batch Cooking Benefits: Analyze savings from cooking larger quantities

- Restaurant Alternative: Compare home cooking vs. dining out costs

Budget Optimization

- Weekly vs. Monthly Shopping: Compare different shopping frequency impacts

- Store Comparison: Analyze costs across different grocery stores

- Category Spending: Break down savings by food category

How to Use the Grocery Savings Calculator

Step 1: Track Your Current Spending

Enter your typical monthly grocery spending, including separate amounts for fresh produce, meat, pantry staples, and household items. Be honest about your current habits for accurate projections.

Step 2: Select Your Savings Strategies

Choose which money-saving techniques you’re willing to implement. Options include couponing, shopping sales, buying generic brands, meal planning, and reducing food waste.

Step 3: Input Your Shopping Preferences

Specify your preferred stores, how often you shop, and any dietary restrictions or preferences that might affect your savings potential.

Step 4: Review Your Savings Potential

Look at your projected monthly and annual savings and specific recommendations for maximizing your grocery budget efficiency.

Proven Benefits of Strategic Grocery Shopping

Significant Cost Reduction

Families using strategic shopping techniques regularly save 25-50% on their grocery bills without compromising nutrition or variety. That could mean $1,500-$3,000 back in your pocket annually.

Better Meal Planning

Focusing on grocery savings naturally leads to better meal planning, resulting in less food waste, healthier eating habits, and reduced stress around mealtime decisions.

Increased Financial Flexibility

Money saved on groceries can be redirected toward debt payoff, emergency savings, or family experiences that matter more than premium food brands.

Improved Nutrition

Strategic shopping often emphasizes whole foods and seasonal produce, leading to better nutrition at lower costs compared to processed convenience foods.

Top Grocery Savings Strategies That Actually Work

Master the Sales Cycle

Most stores follow predictable sales cycles. Meat typically goes on sale every 6-8 weeks, while canned goods and pantry staples cycle every 12 weeks. Stock up during these sales for maximum savings.

Strategic Coupon Use

Combine manufacturer coupons with store sales for maximum savings. Focus on products your family actually uses rather than buying items just because you have a coupon.

Embrace Generic Brands

Store brands typically cost 20-40% less than name brands with minimal quality difference. Start with basic items like flour, sugar, and canned goods.

Plan Around What’s On Sale

Build your weekly menu around store sales and seasonal produce. This flexible approach can cut your grocery bill significantly while introducing variety to your meals.

Common Grocery Shopping Mistakes That Cost Money

Shopping Without a List

Impulse purchases can add 20-30% to your grocery bill. Always shop with a list based on planned meals and current inventory.

Brand Loyalty Without Price Comparison

Sticking to name brands without trying alternatives can cost hundreds annually. Test generic versions of items you use frequently.

Ignoring Unit Prices

Larger packages aren’t always cheaper per unit. Check unit prices to ensure you’re getting the best deal, especially when comparing different brands or sizes.

Shopping When Hungry

Hunger leads to poor decisions and impulse purchases. Shop after meals or bring a healthy snack to maintain focus on your list and budget.

Maximizing Savings Without Extreme Couponing

Focus on High-Impact Items

Concentrate savings efforts on expensive categories like meat, produce, and household items rather than trying to save on everything.

Use Technology to Your Advantage

Store apps, cashback programs, and price comparison tools can provide significant savings with minimal time investment.

Build Relationships with Store Staff

Butchers and produce managers can alert you to upcoming sales or markdowns, helping you plan purchases for maximum savings.

Seasonal Shopping Strategies

Buy seasonal produce at peak season for lowest prices and best quality. Freeze or preserve extras for year-round savings.

Start Saving on Groceries Today

Your grocery budget is one of the easiest areas to reduce spending without impacting your quality of life. With the right strategies, you can cut your food costs significantly while potentially eating better than ever.

Don’t continue overspending on groceries when simple changes could put hundreds of dollars back in your budget each month. Discover your savings potential and get a personalized action plan.

Ready to slash your grocery bill?

Use our Grocery Savings Calculator and discover how much you could save starting with your next shopping trip.