Why Single-Income Planning Matters More Than Ever

Making the transition to single-income living or optimizing your current one-income household? Our comprehensive calculator helps you plan with confidence.

Whether you’re considering staying home with children, pursuing education, starting a business, or facing job loss, planning for single-income living requires careful financial strategy. Nearly 30% of families rely on one primary income, making smart budgeting essential for financial stability.

Our One-Income Calculator takes the guesswork out of this transition, helping you understand exactly what your financial picture will look like and how to make it work successfully.

Key Features of the One-Income Calculator

Comprehensive Income Analysis

- Net Income Calculation: Automatically calculates take-home pay after taxes, insurance, and other deductions

- Multiple Income Sources: Accounts for part-time work, freelancing, or side hustle income

- Benefit Tracking: Includes health insurance, retirement contributions, and other employer benefits

Detailed Expense Planning

- Essential Expenses: Housing, utilities, food, transportation, and healthcare costs

- Lifestyle Adjustments: Entertainment, dining out, subscriptions, and discretionary spending

- Childcare Considerations: Savings from reduced childcare when a parent stays home

- Emergency Planning: Recommendations for emergency fund size based on single-income risks

Smart Recommendations

- Budget Optimization: Identifies areas where you can reduce expenses

- Income Boosting: Suggests ways the non-working spouse can contribute financially

- Timeline Planning: Shows how long your savings will last during transition periods

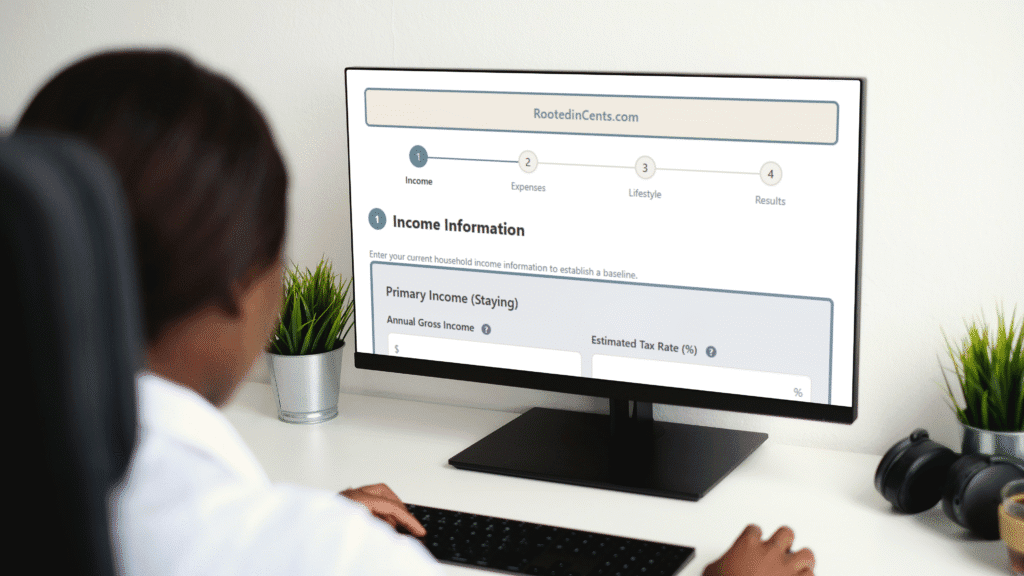

How to Use the One-Income Calculator

Step 1: Enter Your Current Financial Information

Start by inputting your current household income, including salaries, bonuses, and any side income. The calculator will automatically compute your net income after taxes and deductions.

Step 2: Detail Your Monthly Expenses

List all your current monthly expenses, from fixed costs like rent and car payments to variable expenses like groceries and entertainment. Be thorough , accuracy here determines the reliability of your results.

Step 3: Plan Your Lifestyle Changes

Consider how your expenses might change on one income. Will you save on commuting costs? Reduce dining out? The calculator helps you model these adjustments realistically.

Step 4: Review Your Results

See your projected monthly surplus or deficit, recommended emergency fund size, and personalized tips for making single-income living work for your family.

Real-World Benefits for Your Family

Financial Clarity and Confidence

Remove the anxiety of “what if” scenarios by seeing exact numbers. Know precisely how much income you need and where you can adjust expenses to make single-income living sustainable.

Informed Decision Making

Whether you’re planning to leave your job or facing unexpected income loss, make decisions based on data rather than fear. The calculator shows multiple scenarios so you can choose the best path forward.

Goal Setting and Progress Tracking

Set realistic savings goals, debt payoff timelines, and expense reduction targets. Track your progress as you optimize your single-income budget over time.

Stress Reduction

Financial uncertainty creates stress. Having a clear plan and realistic expectations helps reduce anxiety about money and allows you to focus on what matters most to your family.

Who Should Use This Calculator?

- New Parents: Planning for one parent to stay home with children

- Caregivers: Considering leaving work to care for aging parents

- Students: Supporting a spouse through school or career training

- Entrepreneurs: Transitioning from employment to starting a business

- Job Seekers: Planning finances during unemployment periods

- Early Retirees: Living on one income while the other spouse continues working

Expert Tips for Single-Income Success

Before Making the Transition

- Build an emergency fund covering 6-12 months of expenses

- Pay off high-interest debt to reduce monthly obligations

- Research health insurance options and costs

- Practice living on one income for 3-6 months while still earning two

Maximizing Your Single Income

- Negotiate salary increases or benefits before leaving your job

- Consider the non-working spouse’s potential for part-time or freelance income

- Take advantage of tax benefits for single-income families

- Explore cost-saving opportunities like meal planning and bulk buying

Start Planning Your One-Income Future Today

Don’t let financial uncertainty hold you back from the lifestyle choices that matter to your family. Our One-Income Calculator provides the clarity and confidence you need to make informed decisions about your financial future.

Take control of your finances and discover how single-income living can work for your family.

Ready to plan your single-income future? Use our One-Income Calculator now and get personalized recommendations for your family’s financial success.

This article is part of RootedinCents.com’s comprehensive financial planning toolkit. For more money-saving tips and financial calculators, explore our complete resource library.